This article comes from Greg Larsen’s talk, ‘Winning with win/loss analysis’, at our 2023 Revenue Acceleration Festival.

Does your sales team seem stuck in an endless cycle of deflecting fault after losing major deals? Well, you're not alone.

Over my 15+ year career building successful SaaS companies, I’ve learned firsthand how critical an effective win/loss analysis program is for growth.

In this article, I want to walk you through my 4-pillar approach to win/loss that I’ve developed from direct experience losing deals and needing to course correct.

Think back to a time when your company lost a major deal. Why did you lose? Price, product, sales execution?

Many companies go quarter after quarter without truly understanding the root causes behind won and lost deals, leading to guesswork and frustration.

Today, I’ll aim to show you a better way. My win/loss analysis approach rests on four pillars:

- Leadership & Culture

- Proper Data Collection

- Thoughtful Data Analysis

- Actionable Next Steps

Getting this formula right has helped me repeatedly drive higher win rates. Now let’s uncover the real reasons you win and lose deals…

What is win/loss analysis?

Let's start with a quick definition for anyone unfamiliar with the term. Win/loss analysis is the process of gathering data around both won and lost sales deals to uncover trends impacting your win rate.

By interviewing participants from your own company as well as the buyer on unsuccessful deals, you build an accurate picture of:

- Why you win deals

- Why you lose deals

- Your strengths vs. competitors

- Product gaps to fill

- Price objections

- Other sales obstacles and opportunities

Armed with these qualitative and quantitative insights, execs can make smart resource allocation decisions and sales can refine helper messaging. Instead of flying blind and making gut calls, you drive a data-backed strategy.

Many RevOps leaders struggle to get win/loss analysis right. Their programs either fail completely, only provide surface-level insights, or aren't actionable.

Pillar 1: Leadership & culture

You can’t have an effective win/loss program without complete buy-in and participation from the CEO and executive leadership team.

They must lead the charge in establishing a culture of learning vs punishment around loss analysis.

I saw this done perfectly early in my career at Qualtrics. Every week the CEO, CFO, and other executives would stand up in front of the entire company and talk openly about that week’s business highlights and lowlights.

Then our CEO would discuss a mistake he made recently, what he learned and, how he'd improve. Suddenly employees felt empowered to take smart risks without the fear of failure.

Leaders would even highlight team members who openly discussed their mistakes and reward them for it, this complete acceptance of missteps as learning opportunities is the type of culture that encourages accurate inputs across all departments.

Without a top-down cultural commitment to transparency and discussing failures, RevOps can rarely get the participation needed across sales, marketing, and product to connect the dots on losses.

Pillar 2: Proper data collection

Now you’ve got leadership support, we need to architect a data collection approach that gives us a complete 360 view.

Proper planning prevents poor analysis, here are some of the key steps my team takes:

🎯 Establish agreed goals & benchmarks upfront – Make sure everyone from sales to product to marketing agrees upfront on the goals of the program and defines success benchmarks.

👉 Assign ownership of each step – Clearly outline who owns collecting data from sales, product, the customer, 3rd parties, and how we bring it all together for analysis.

💬 Never rely solely on sales rep inputs – In over 20 years in sales, I've never seen a rep voluntarily raise their hand and say, "I clearly blew that deal." Inputs only from Sales will give you a warped perspective.

🏛️ Build a multi-layered data collection pyramid:

- Level 1 – Basic fields in the CRM – Add simple required Loss Analysis fields like Competitor Chosen, Primary Loss Reason, etc.

- Level 2 – Auto-surveys to full opportunity teams – For all deals over $100K, auto-trigger a short survey to everyone who touched that deal to capture additional color.

- Level 3 – Customer win/loss interviews – Actively reach out to buyers on significant lost deals with a structured interview process.

- Level 4 – 3rd party win/loss interviews – Expensive but this outside-in view yields an incredibly candid perspective not possible internally.

Following this method gives you quantitative and qualitative data from every angle to uncover the true loss drivers.

Now let’s discuss translating this rich data into insights.

Pillar 3: Thoughtful data analysis

Armed with robust inputs, we now have to make sense of it all without drawing quick conclusions or overreactions. Here are my key principles:

- Track insights over the long term – That huge deal you just lost stings, but don’t change strategy based on one data point. Build statistical significance over 12+ months before making major moves.

- Balance quantitative and qualitative data – You need both hard metrics on pricing or product gaps AND color on why buyers preferred your competitors to get the full story.

- Make analysis visual whenever possible – Executives often gloss over detailed Excel pivot tables. Turn key findings into simple, engaging graphs that pop key trends to drive discussion.

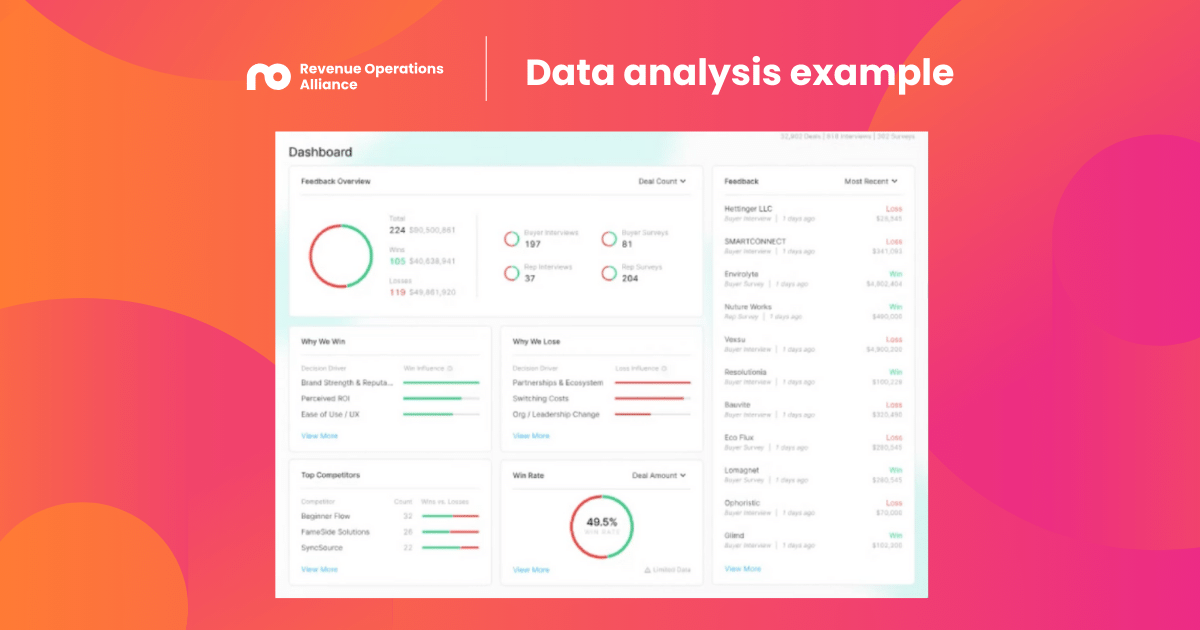

Here’s an example win/loss analysis dashboard highlighting primary loss drivers over 12 months.

At a glance, we can see we lose most commonly on business requirements gaps and pricing vs. competitors, now the product and sales leaders can have informed debates on where to focus.

Pillar 4: Actionable next steps

You watch hours of game footage as a coach to pick the perfect plays, but never sharing this game plan with your team is self-destruction.

Yet this happens all too often in business after win/loss analysis.

Here are some of my action principles to get around this issue:

- Widely share results cross-department to align around learnings – Growth comes through transparency on what needs improving. If your culture can’t handle open discussion, revisit Pillar 1.

- Hold regular executive win/loss reviews on recent deals, rotating sales reps involved – We pick 1-2 recent losses, debate what happened, and shape training, products, and pricing accordingly.

- Follow up with every win/loss participant on how we’re addressing their feedback – Close the loop! Thank participants, and keep them updated on new functionality based on their inputs so they convert down the road.

In summary

As much as losing major deals stings, progress requires trading finger-pointing for openness.

Uncovering win/loss truths through data-backed analysis gives us the power to course correct strategically versus emotionally.

Rinse and repeat this four-pillar approach for your win/loss analysis program, and you’ll transform what's often viewed as a necessary evil into an engine for sustainable revenue growth.

I hope mapping an insider’s blueprint gives you the confidence to start asking tougher questions today. You deserve to understand what’s driving deals - won or lost - no matter your role.

There’s nowhere to go but up!