Something fundamental has shifted in how companies view revenue operations. And the numbers are stark.

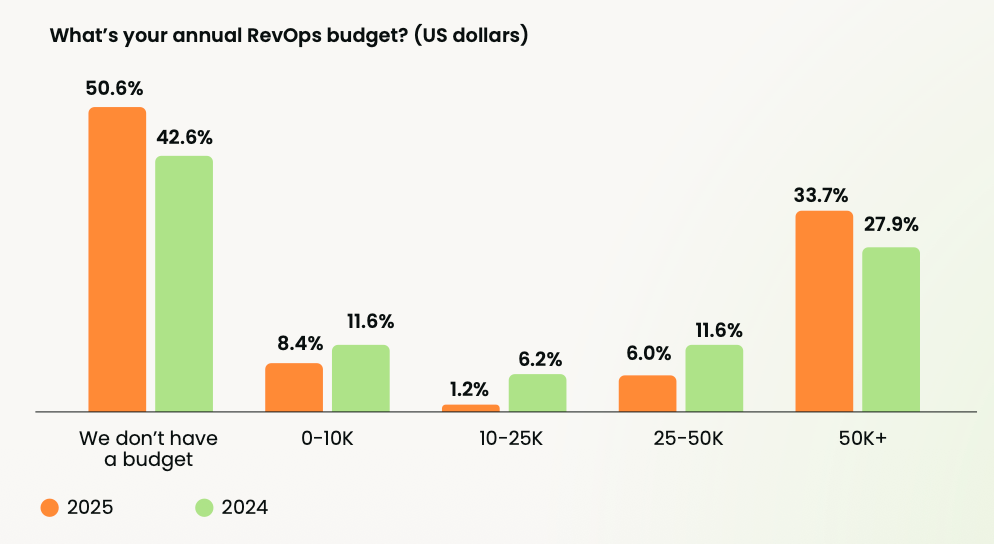

According to our latest RevOps Salary and Landscape Report, half of all RevOps teams (50.6% to be exact) now receive no budget whatsoever. That's up 8% from last year. At the same time, the percentage of teams receiving $50,000 or more jumped by nearly 6%, reaching 33.7%.

Think about what that means: The middle is disappearing. You're either critical infrastructure worthy of serious investment, or you're an expendable cost center.

There's no in-between anymore.

Budget polarization is on the rise

Last year, we saw hints of this trend. This year, it's undeniable. Budget allocation in RevOps has been pushed to extremes, with a 13.8% drop in teams receiving moderate budgets (up to $50,000). Those dollars didn't vanish; they moved. Either up to well-funded teams, or down to nothing at all.

The data tells us exactly which category is growing faster. Teams with zero budget are expanding more rapidly than those with significant funding. That should concern you.

This isn't about economic headwinds affecting everyone equally. Instead, the data points to the realities of companies making binary decisions. Your RevOps function is either demonstrably valuable enough to double down on, or it's vulnerable.

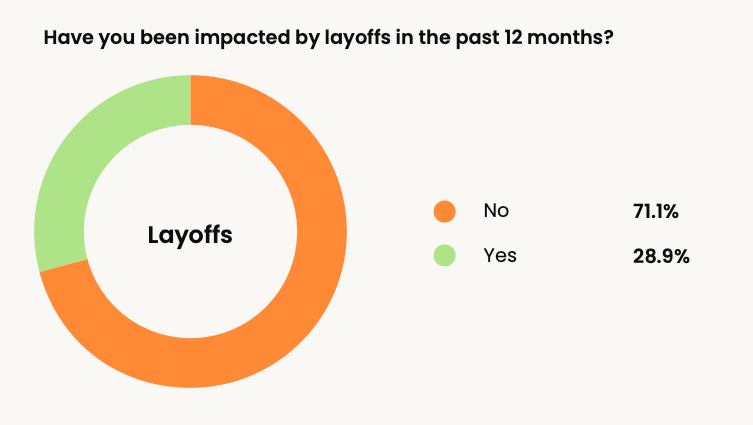

The layoff wave hit harder than you think

Here's another number that matters: 28.9% of RevOps professionals were personally impacted by layoffs in the past 12 months. Nearly one in three.

You might have felt this in your network. Maybe you've seen the LinkedIn posts. Perhaps you've watched colleagues disappear from Slack channels. The data confirms what many of us suspected: RevOps has been in the crosshairs during this wave of tech sector cuts.

More than 100,000 positions have been eliminated across the technology sector. When companies started scrutinizing every function for demonstrable ROI, operational roles faced pressing questions. What revenue are you generating? What costs are you preventing? Can we prove your value in dollars?

For some RevOps teams, those questions had clear answers. For others, the answers were harder to articulate.

How to tell which camp you're in

You need to know if you're viewed as critical infrastructure or a cost center. The signs aren't always obvious, but they're there.

Start with influence. Do you get invited to leadership meetings? Not just sometimes, but consistently?

The data shows that 20.5% of RevOps professionals now report they're never invited to leadership discussions. That's up from 12.4% last year. If you've lost your seat at the table in the past year, that's a warning sign.

Look at how leadership talks about your work. Are they asking about the metrics and KPIs you're tracking? Or are they asking about the revenue impact of those metrics? There's a difference. The first suggests they see you as operational support. The second suggests they see you as part of the revenue engine.

Check your budget allocation. We found that teams spending 64% of their budget on tech solutions are often the ones stuck in manual data cleansing, the number one time-wasting activity cited by 49.3% of RevOps professionals. If you're spending heavily but still firefighting, that's a perception problem waiting to happen.

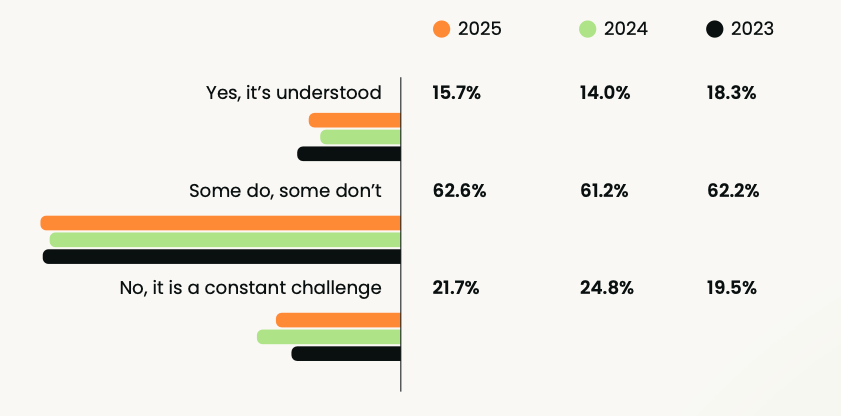

Here's a harder question: What percentage of your time goes to strategic work versus tactical firefighting? The data shows that only 15.7% of RevOps professionals feel their role is fully understood across their organization. When leadership doesn't understand what you do, they often see you doing the tactical stuff. The manual work. The support tickets.

They don't see the strategy.

The teams that are winning

We're seeing consolidation among many RevOps functions. The percentage of professionals working in teams of 15 or more people more than doubled from 8.5% last year to 19.2% this year. Larger teams with bigger budgets are absorbing responsibilities, expanding scope, and cementing their position as essential infrastructure.

These teams also show different patterns in how they allocate resources. They're not just spending on tech, but are spending on people who can leverage that tech strategically. They're building capabilities, not just maintaining systems.

The influence scores tell the story, too. While average influence declined across most seniority levels this year, the most senior RevOps leaders (VP and Director level) actually reported seeing their influence on sales increase. The gap between senior leaders and everyone else is widening.

What this means for your next move

If you're in a well-funded RevOps function, understand that you're in an increasingly privileged position. So the question becomes how to capitalize on your momentum.

Push for scope expansion. Build capabilities that are hard to replicate. Make yourself indispensable to the revenue engine.

If you're in the 50.6% with no budget, you need to make a decision. Can you change the narrative in your current role? Do you have access to leadership? Can you reframe your work in terms of revenue impact rather than operational efficiency?

The gap between funded and unfunded teams will likely widen, and being stuck on the wrong side of that divide has real career implications.

Here's what the salary data shows: Geography, industry, and company maturity matter more than you think. Remote workers earn $144,000 on average compared to $107,000 for office-based professionals. Software and tech companies pay $141,000 versus $97,000 in advertising and marketing. Companies at mid-growth stage or beyond pay significantly more than early-stage organizations.

Your career decisions about where and how you work matter as much as your job title.

The strategic repositioning you need to make

The declining influence scores across most RevOps roles suggest a perception problem. Average scores dropped for specialists, analysts, and mid-level managers. Only the most senior leaders held steady or gained ground.

This tells us something important: Title inflation without actual strategic authority is catching up with the profession. Being called a "Revenue Operations Manager" doesn't automatically give you influence. You have to earn it by demonstrating revenue impact.

Stop talking about the number of dashboards you maintain. Stop leading with your tech stack. Stop emphasizing process optimization unless you can tie it directly to dollars.

Start every conversation with revenue impact. When you clean data, you're preventing revenue leakage from mis-routed leads. When you optimize the tech stack, you're reducing friction in the buyer journey that costs deals. When you build dashboards, you're surfacing insights that help reps close faster.

The language matters. And so does the framing.

The teams surviving this polarization are the ones who've made this shift. They speak the language of revenue, not operations. They show up in leadership meetings with revenue insights, not operational updates. They position themselves as strategic partners in growth, not tactical support for the sales team.

Looking ahead

The 2025 Revenue Operations landscape presents a profession at a crossroads. Budget polarization, layoffs, and declining influence for mid-level roles paint a challenging picture. But there's opportunity here too.

The teams that are thriving are genuinely thriving. Bigger budgets. Growing headcount. Expanding influence. The gap between them and everyone else just makes their position clearer.

You need to decide which side of this divide you're on. And if you're on the wrong side, you need to decide what you're going to do about it.

Because the middle ground is disappearing. And it's not coming back.

Want to see how your compensation stacks up?

The full 2025 Revenue Operations Landscape & Salary Report includes comprehensive salary data by region, industry, experience level, and company size, plus detailed breakdowns of budget allocation, team structure, and the metrics that matter most to leadership.

Download the complete report to benchmark your position and plan your next move.

6 min read

6 min read

Follow us on LinkedIn

Follow us on LinkedIn